The Basics Of Bad Credit Loans

Looking for a personal loan, this handy guide will help you understand your options and help to explain how loans effect credit, repayment, APRs and more. Learn the best way to borrow for your particular situation and circumstance.

Bad credit follows you. The best thing you can do for yourself is to clear it up as soon as possible so lending partners, landlords and employers will smile fortune down upon you. A credit loan can be a great way to do just that.

Your Credit Score: The Good, The Bad & The Ugly

This is like a karmic report card that keeps a record of every loan or payment that you have defaulted on. The more that has happened in your past, the lower your credit score is going to be, and the harder it can become to get a loan, secure a rental property, or even land a job.

Your credit score shows how reliable you are in paying your bills. Unreliability means lending partners take a bigger risk giving you a loan and, therefore, will charge you high interest rates. The standard scoring system in the US is the FICO Score and it typically falls within a range of 300-850. If you do not know your credit score, the government has provided these three organizations where you can get your credit report each year for free: Equifax, Experian, and TransUnion.

The Importance of Good Credit

Having a bad credit score can affect more than just being denied a loan. There is a whole spectrum of ways it can affect your life, including:

Employment

A whopping 47% of employers check the credit of applicants. It doesn’t seem quite fair, but it is a legal way they can determine your reliability.

Rental Properties

It is most definitely within a landlord’s rights to check your credit before renting you a place.

Utilities & Other Bills

Without good credit, you could be paying big deposits on heat, gas and water.

Mortgage

Obviously, if you have a bad credit score, your chances of getting a mortgage are greatly reduced. If you are able to secure one, you will most likely be paying a high interest rate.

How Your Credit Score is Determined

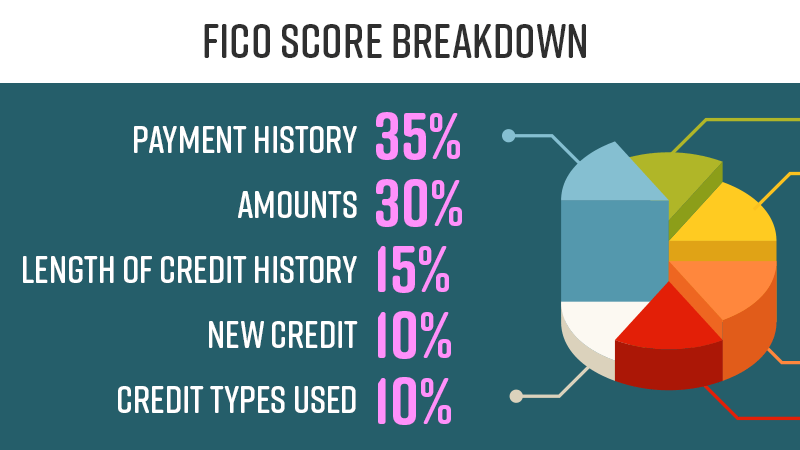

So how is your FICO score calculated? Here is a breakdown:

Payment History: 35%

Have you paid your bills on time?

Outstanding Debt: 30%

How much do you owe right now?

Length of Credit History: 15%

How long have you been using credit or had bills in your name?

New Credit Applications: 10%

Have you applied for more than one credit product recently?

Credit Types: 10%

Do you have a mortgage, personal loans, credit cards, etc.?

Average Credit Scores

Once all the aspects of credit scoring are rated, the numbers can range from 1-800. Anything below about 500 is considered a bad credit rating and anything higher than 750 is considered good. Most people (27%) have a crediting score of 750 and only 2% have a score less than 500.

It is no surprise that 18-24 year olds have the lowest credit scores and that people over 55 have the best.

How Do You Get a Loan With Bad Credit?

There are plenty of loan options for folks with bad or poor credit. The hard truth is you, you should always be working to improve your current credit situation. Higher scores mean less interest and headaches. Here are a few loans options:

- Bank at a credit union

- Borrow from friends and family

- Peer-to-peer lending partners

- Apply for a credit loan here online

Fixing Your Bad Credit Score

There are some simple steps to turning your bad credit around, including:

Pay Off High Interest Debt First

Credit cards specifically and then any other outstanding debt with a high interest rate.

Pay Your Bills When They Are Due

This is a big one. It doesn’t take long before credit departments will begin to recognize you are paying your bills on time.

Get Rid of Credit Cards

Pay down your balance and try to keep your balance at only 10% of your maximum. Try consolidating your credit card debt onto one card.

Check Your Credit Report Annually

Equifax, Experian, and TransUnion will provide you with your free credit report every year. Make sure you check for any mistakes and report them to your creditors.

Fixing your bad credit score increases your chances of securing personal loans or mortgages with the best interest rates. However, 25% of Americans still have bad credit ratings. A bad credit loan can be used to pay off the debt that is pulling your credit score down and turn you into a great candidate for rentals, jobs and loans.

How You Can Secure your Credit Loan

Using our secure form, you can safely submit your information to a lender online. You should know almost immediately if your loan is approved, and have access to the funds as soon as tomorrow.

Attaining a credit loan could be your answer to turning your bad debt into a good credit score!